Exness ECN Review

When looking for a reliable trading platform, many traders consider the Exness broker as a viable option. This exness ecn review exnessbrokerage.com review will delve into the specific features of the ECN account offered by Exness, discussing its advantages, trading conditions, and overall performance in the forex market.

Overview of Exness

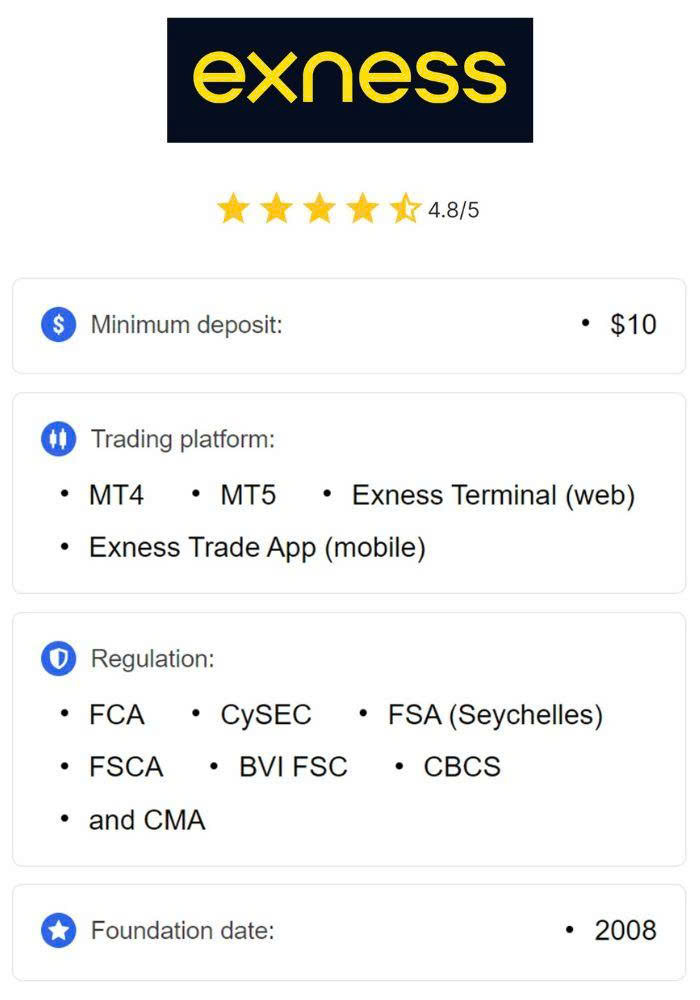

Founded in 2008, Exness has rapidly grown to become one of the leading Forex brokers in the industry. It operates globally and is known for its transparent trading conditions, quick fund withdrawals, and diverse account offerings. The firm is regulated by several authoritative bodies, ensuring that client funds are protected and the trading environment remains secure.

What is an ECN Account?

ECN stands for Electronic Communication Network, which is a type of trading account that allows direct access to the interbank market. This type of account is aimed at experienced traders who wish to take advantage of tight spreads, low latency, and the ability to trade without the intervention of a trade dealer. An ECN account typically offers the following benefits:

- Direct Market Access: Traders can access liquidity providers directly, which can mean better pricing.

- Tight Spreads: With an ECN account, the spreads can be as low as 0 pips, depending on market conditions.

- Execution Speed: Trades are executed quickly, which is crucial in fast-moving markets.

Exness ECN Account Features

Exness offers an ECN account that stands out due to its array of features designed to facilitate trading efficiency. Below are notable features that are part of Exness’s ECN account:

- Account Types: Exness offers several account types, including the ECN account, which provides different trading conditions to suit various trader needs.

- Leverage: The ECN account at Exness offers flexible leverage options, up to 1:2000, which can enhance the buying power of traders.

- Min Deposit: The minimum deposit requirement for an ECN account is competitive, providing greater accessibility for traders starting with limited capital.

- Commission Fees: Traders should be aware of the commission model. Exness charges a small commission per trade on ECN accounts, which is offset by the tight spreads.

Trading Instruments

Exness provides access to a wide range of trading instruments across various asset classes. These include:

- Forex: Trade currency pairs from major to exotic currencies.

- Commodities: Access to a range of commodities including gold, silver, and oil.

- Indices: Trade major global indices, allowing traders to leverage market movements.

- Cryptocurrencies: Diverse options in the increasingly popular cryptocurrency market.

Trading Platforms

Exness offers multiple trading platforms to cater to different trading styles and preferences:

- MetaTrader 4: One of the most popular trading platforms featuring advanced charting tools and automated trading options.

- MetaTrader 5: The successor to MT4, offering additional features like more timeframes and advanced order types.

- WebTrader: A browser-based platform that allows trading from any device without installation.

- Mobile Applications: Mobile trading applications are available for both iOS and Android, ensuring traders can manage their accounts on the go.

Customer Support and Education

Effective customer support is essential for traders, and Exness excels in this area as well. The support team is available 24/7 via multiple channels, including:

- Live Chat

- Email Support

- Phone Support

Additionally, Exness provides a variety of educational resources such as webinars, video tutorials, and articles to help traders of all levels improve their trading skills.

Deposit and Withdrawal Methods

Exness offers a broad range of deposit and withdrawal methods, making it easy for traders to manage their funds. Notable options include:

- Bank Transfers: A reliable way to deposit and withdraw funds.

- Credit/Debit Cards: Fast processing times and global reach.

- E-wallets: Including popular methods like Skrill, Neteller, and more for quick transactions.

Exness is known for swift withdrawals, with many methods allowing for processing in under 24 hours.

Pros and Cons of Exness ECN Account

Understanding the advantages and disadvantages of trading with Exness’s ECN account can help traders make informed decisions:

Pros:

- Tight spreads and low commission structure.

- High leverage options available.

- Wide range of trading instruments.

- Robust customer support and educational resources.

Cons:

- Commission fees on trades may not be ideal for all traders.

- Limited bonuses compared to some other brokers.

Conclusion

In conclusion, the Exness ECN account represents a compelling choice for both experienced traders and those looking to step into the world of ECN trading. With a robust trading platform, a range of instruments, responsive customer support, and a variety of account options, Exness positions itself as a strong contender in the forex market. Like any trading decision, it’s crucial for traders to weigh the pros and cons and consider their own trading strategies and goals before opening an account.

Whether you are an experienced trader or new to the world of forex, taking the time to understand the benefits of the Exness ECN account could significantly enhance your trading experience.